Calculator

LBB Chartered Surveyors Calculator

Welcome to our calculator. The calculator is designed to help our current and future clients with their Lease Extension and Enfranchisement. Our calculator is designed to assist you. It does not provide formal valuation advice but will give you an indication of what your premium may be.

What is a lease extension?

The Leasehold Reform Housing and Urban Development Act 1993 (as amended) entitles a tenant, subject to 2 years registered ownership, to claim a 90-year lease extension to the original lease term. The new lease will have a peppercorn ground rent throughout that new extended term.

If the lease has an unexpired term of more than 80 years any marriage value is ignored. The date of valuation is the date of receipt of the Section 42 notice. An unrealistic premium offer can render a notice invalid. This is as the tenant’s notice is considered by the courts to be a contractual offer. Following receipt of a Section 42 notice, a landlord has to serve counter-notice within two months, or the date stated within the notice, if later. The courts have stated that a landlord’s counter-notice (under Section 45) is not contractual, therefore does not need to state a realistic premium figure. Failure for a landlord to respond to a tenant’s notice in time will normally oblige the landlord, subject to a vesting order from the court, to accept both the premium proposal (if realistic) and any proposed amendments to the lease. The basis of valuation of the lease extension premium is subject to the following statutory formula, which is the sum of the following:

- The diminution of value in the landlord’s interest in the flat [reduction in value],

- The landlord’s share of the marriage value,

- Any other amount of compensation payable.

What is a Section 42 Notice?

This is the notice of claim. It is a formal notice that states the identity of the parties to any lease extension, the basis of qualification, the amount initially offered and the date by which the landlord must reply. In some cases, there is more than one landlord, for example where there is a head lessee or intermediate lessee. Whilst our calculator will let you have an indication of the level of premium, it will not apportion premiums, but our surveyor would be delighted to help you.What is diminution in the value of the landlord’s interest?

This is the difference between the value of the landlord’s interest before the lease extension and the value of their interest after the lease extension. Prior to a lease extension, the landlord will probably have a ground rent income from the lease term. He will also receive the flat back at the end of that lease. As such, their interest before the lease extension is made up of the sum of:- The capitalised value of the rental income payable under the existing lease;

- Plus, the present value to the landlord of receiving the flat at the end of the existing lease.

- The present value to the landlord of receiving the flat at the end of the extended lease.

What is marriage value?

Marriage value is defined in the legislation and essentially it is the profit released from marrying the interests of the parties after the lease extension and comparing it to the respective interests before the extension. On occasion it may be small but as the length of your lease reduces the difference becomes bigger. It is basically: The aggregate of:- the value of the interest of the tenant under his new lease; and

- the interest of the landlord(s) after the grant of the new lease

How is marriage value calculated?

A longer lease of a property will be more valuable than a shorter lease of a property. On this basis, the freehold would represent the most valuable asset. If the freehold represents 100% of value, valuer will often refer to the relative value of the lease – or relativity.What is Relativity?

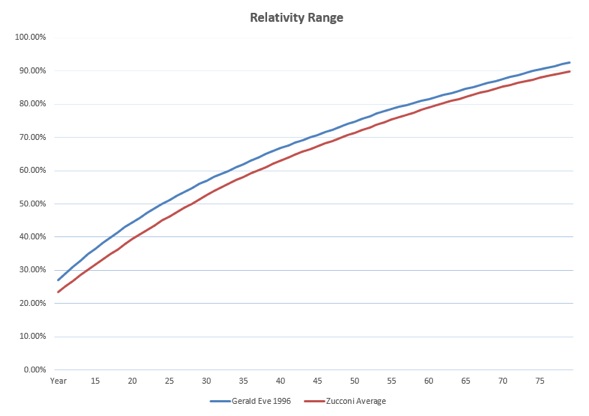

Relativity is an expression used to measure the difference in price between a leasehold value and that of an effective freehold. It is often expressed as a percentage. Historically this was established by negotiation, “graphs”, tribunal, or other determinations. Graphs of Relativity are still used, but the tribunals will prefer market evidence of sales of short leases. The graph below is the graph used in the calculations on this website. It shows the how the value of a lease reduces as the lease term reduces. It is not a definitive graph but illustrative in allowing us to help you.

Your results explained

For assistance please email us on info@lbb.org.uk There are numerous variables in the valuation that develops the premium range. Each variable will have a margin for negotiation. This is why it is necessary to obtain proper professional advice before embarking on a lease extension. The main variables are:- Capitalisation rate;

- Deferment rate;

- Lease length / Relativity;

- The "no Act world"; and

- Tenant's improvements.